wells fargo class action lawsuit payout

Consumers who paid off their car loans early and paid what they say were improper GAP insurance fees. Lead plaintiff Armando Herrera had alleged Wells Fargo collected the entire amount of the loan including the cost of the GAP insurance coverage.

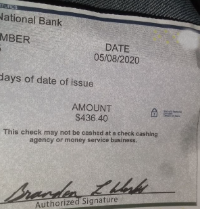

Wells Fargo Foodstate Settlement Checks In The Mail Top Class Actions

Class Action Settlements.

. The suit is a result of an investigation by the Securities and Exchange Commission into the father-son investment firm EquityBuild. These big banks dont have the right to charge overdraft fees and they must pay you back to protect their reputation. Plaintiffs Reply In Support of Motions for Final Approval of Class Action Settlement and Attorneys Fees and Brief of Amicus Curiae PDF Court Orders.

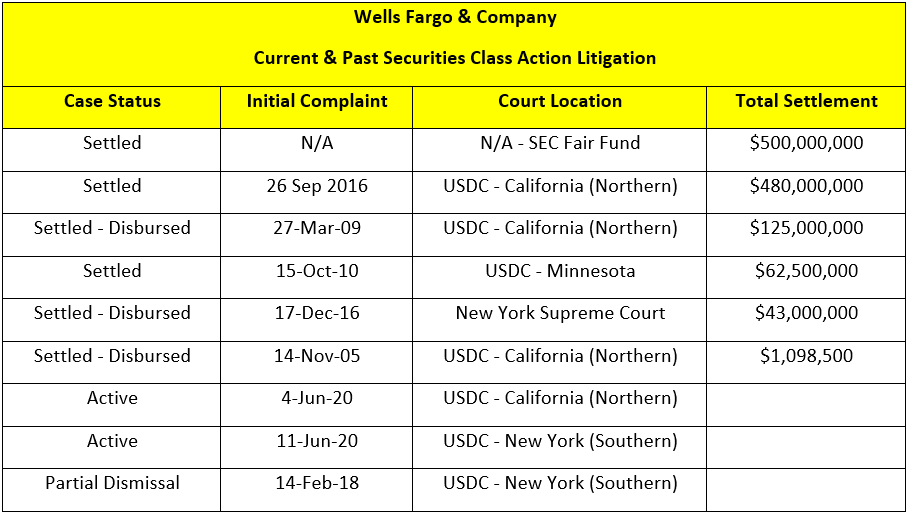

Feb 23 Reuters - Wells Fargo Co was hit with a proposed class action lawsuit on Wednesday accusing the bank of routinely requiring hourly employees in Florida to work overtime without pay. Wells Fargo will pay 500 million to end a class action lawsuit refunding US. The class size is limited to a maximum of 200000 homeowners.

This settlement resolves a lawsuit against Wells Fargo Bank NA Wells Fargo Co National General Holdings Corp. Reimbursement payments and distribution payments. A class-action lawsuit against the Resort Marketing Group is being investigated by.

The SEC also filed a similar lawsuit against Wells Fargo in May bringing the largest ever class action lawsuit against a bank. Some of the claims include high-pressure sales tactics forged signatures and unauthorized account opening. Under the terms of the Wells Fargo class action lawsuit settlement Class Members can collect two types of cash payments.

Wells Fargo Alter Egos Sold Predatory Home Loans Engineered to Foreclose Claims Borrowers Lawsuit. The investors were misled by the banks cross-sell strategy which involved opening millions. The recent 203 million Wells Fargo overdraft lawsuit payout highlights the problem with big banks unfair practices and is a clear example of how you can take legal action against them.

Ultimately the bank agreed to pay 394 million to address allegations about the unwanted CPIs on car loans. The Wells Fargo overdraft lawsuit payout 2016 was the result of a long court battle. The banks overdraft policy was found to be unconstitutional under federal law.

The company has since apologized and resolved the cases. Wells Fargo says the error affected 625 homes that were in the foreclosure process between April 13 2010 and October 20 2015. The company has agreed to pay 3 billion to resolve the claims.

In re Wells Fargo Collateral Protection Insurance Litigation Case No. Fortunately there are a few steps that you can take to increase your chances of receiving a settlement. Wells Fargo the nations fourth-largest bank agreed Friday to pay a 3 billion fine to settle a civil lawsuit and resolve a.

Wells Fargo Lawsuit Settlemen. Wells Fargo and National General tried getting the lawsuit dismissed but the plaintiffs won. On Wells Fargo Overdraft Lawsuit Payout.

And National General Insurance Company collectively Defendants alleging that between October 15 2005 and September 30 2016 Defendants unlawfully placed collateral protection insurance CPI policies on Class. In addition to filing a class-action lawsuit Wells Fargo is obligated to compensate eligible customers. In the end the company was forced to reimburse overdraft victims 203 million in refunds.

A settlement deal with the Financial Industry Regulatory Authority has settled class action claims made by Wells Fargo. Wells Fargo has not admitted any wrongdoing but agreed to pay 3 million to resolve the claims against it. In the end Wells Fargo agreed to pay 142 million to the affected parties.

Wells Fargo CPI Class Action Settlement. While that number is large this doesnt mean that you should give up hope. Nearly 36 million will be paid out to borrower attorney fees and 500000 will cover attorney expenses.

The suit was filed in May 2015. The Wells Fargo lawsuit resolves claims of fraudulent activities involving unauthorized accounts forged signatures and unauthorized services. The bank has agreed to pay 185 million to resolve the allegations.

Wells Fargo and a group of affiliated mortgage lenders use deceptive tactics to push customers into a complicated risky and expensive loan so they can sell as many loans as possible to third party investors while the. According to news reports the class action lawsuit will be filed by plaintiffs with annuity rates exceeding 10 million. A class-action lawsuit against Wells Fargo is currently underway but the allegations are complex and have been the subject of many recent news reports.

Wells Fargo has committed to or already provided restitution to consumers in excess of 600 million through its agreements with the OCC and CFPB as well as through settlement of a related consumer class-action lawsuit and has paid over 12 billion in civil penalties to the federal government and to the City and County of Los Angeles. The securities filing says that Wells Fargo discovered a calculation error in its automated software for calculating whether a borrower should be offered more favorable loan terms in lieu of foreclosure. Although the settlement does not completely.

A class-action suit against Wells Fargo alleges that the bank helped execute a 135 million Ponzi scheme while knowing about it. The settlement includes 500 million in investors money. The final approval of a 28 million CIPA settlement agreement between Wells Fargo and its customers has been granted.

Reimbursement payments are available to Class Members who made. Wells Fargo CIPA Settlement Receives Final Approval. 1 day agoWells Fargo paid nearly 36 million to about 320 members of the class-action lawsuit and pledged to take actions designed to enhance opportunities for employment earnings and advancement of.

Those with a Wells Fargo loan may be able to benefit from the settlement if between 2010 and. Classes in this case are said to include all current and former homeowners that received. Wells Fargo home loan customers who lost their homes may be able to benefit from an 185 million settlement that if approved by the court will end a class action lawsuit alleging bank errors led to mortgage holders losing their homes to foreclosure.

Wells Fargo CIPA Settlement 2021 28 Million To Businesses Whose Calls Were Recorded Without Consent By Consider The Consumer on 01102022. By Pete Williams.

Johnson Burgee S Taut Sliced Wells Fargo Center Denver 1983 Building Skyscraper Future City

Wells Fargo Foodstate Settlement Checks In The Mail Top Class Actions

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

Wells Fargo Agrees To 3 9m Settlement With For Wage Violations

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Wells Fargo Pays 12m For Wrongly Denying Mortgage Modifications Housingwire

Wells Fargo Paying 3 Billion To Settle U S Case Over Illegal Sales Practices Npr

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement Bankrate Com

Here S Every Wells Fargo Consumer Scandal Since 2015

Wells Fargo Unauthorized Accounts Class Action Settlement Top Class Actions

Wells Fargo Refuses Black Female Judge In Class Action Racial Discrimination Case

A Black Homeowner Is Suing Wells Fargo Claiming Discrimination The New York Times

Keller Rohrback L L P Wells Fargo Agrees To Pay 110 Million To Resolve Consumers Class Action Lawsuit About Unauthorized Accounts Keller Rohrback

Wells Fargo Account Fraud Scandal Wikiwand

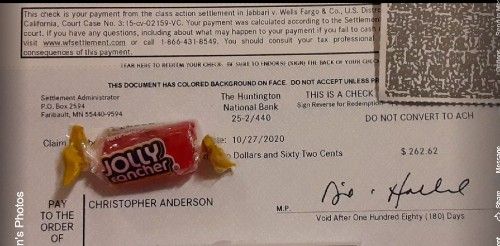

Four Settlement Checks In The Mail Top Class Actions

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

Wells Fargo Mortgage Forbearance Class Action Lawsuit Dropped Top Class Actions

:max_bytes(150000):strip_icc()/Wells_Fargo_Recirc-cb9d83efd7f04a6c8900447ffc94b256.jpg)