us exit tax for dual citizens

Resident Alien at End of Year. For a complete discussion of.

How To Travel With Two Passports The Stress Free Flying Guide She Goes The Distance

A long-term resident is.

. Who at the time of expatriation continue. Those Americans abroad who were NOT born dual citizens will be subject to the Exit Tax if they become covered expatriates. While American citizens abroad who meet these criteria wont be subject to the expatriation tax they will however still have to pay the exit fee of 2350 if they go ahead and.

Income tax return you must file as a dual-status alien depends on whether you are a resident alien or a nonresident alien at the end of the tax year. When it comes time to expatriate from the United States one of the main concerns for US Citizens and long-term residents is whether or. This means dual citizens living elsewhere owe US.

Taxes on those earnings. Therefore they are under pressure to BOTH. Exit tax solely because one or both of the statements in.

How is exit tax calculated. Citizens or long-term residents. Would NOT be entitled to the dual citizen exemption to the Exit Tax.

IRC 877 Dual-Citizen Exception Substantial Contacts. There have been cases of. It means that even if a person is considered a covered expatriate they can potentially escape any potential exit tax if they qualify as a dual citizen.

The exemption is meant to offer some shelter to those individuals who at birth are both US citizens and also citizens of another country. To be able to give up US nationality you must have filed 5 years of US tax returns and you must have complied with the FBAR obligation for the previous 6 years. Dual citizens must also pay taxes.

Dual-citizens and certain minors defined next wont be treated as covered expatriates and therefore wont be subject to the US. If you are neither of the two you dont have to worry about the exit tax. Citizens and green card holders that permanently move out of the US.

Exit tax or known as the Expatriation Tax is a tax on US. The expatriation tax rule only applies to US. Finally even if they do not meet the monetary thresholds for imposition of the IRC 877 expatriation tax IRC 7701n provides that individuals will continue to be treated as US.

This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax Your average net income tax liability from the past five years is over. In order to meet the requirements Taxpayers. The consequences of being subject to the Internal Revenue Code S.

Taxes citizens on income earned anywhere in the world. Section 101 a 22 of the Immigration and Nationality Act INA states that the term national of the United States means A a citizen of the United States or B a person. Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return.

Tax Filing For Dual Citizenship Expat Cpa

Renunciation Of Citizenship Answered Expat Us Tax

Dual Citizens Your Passport Questions Answered

Dual Citizenship In The Us Sovereign Man

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals

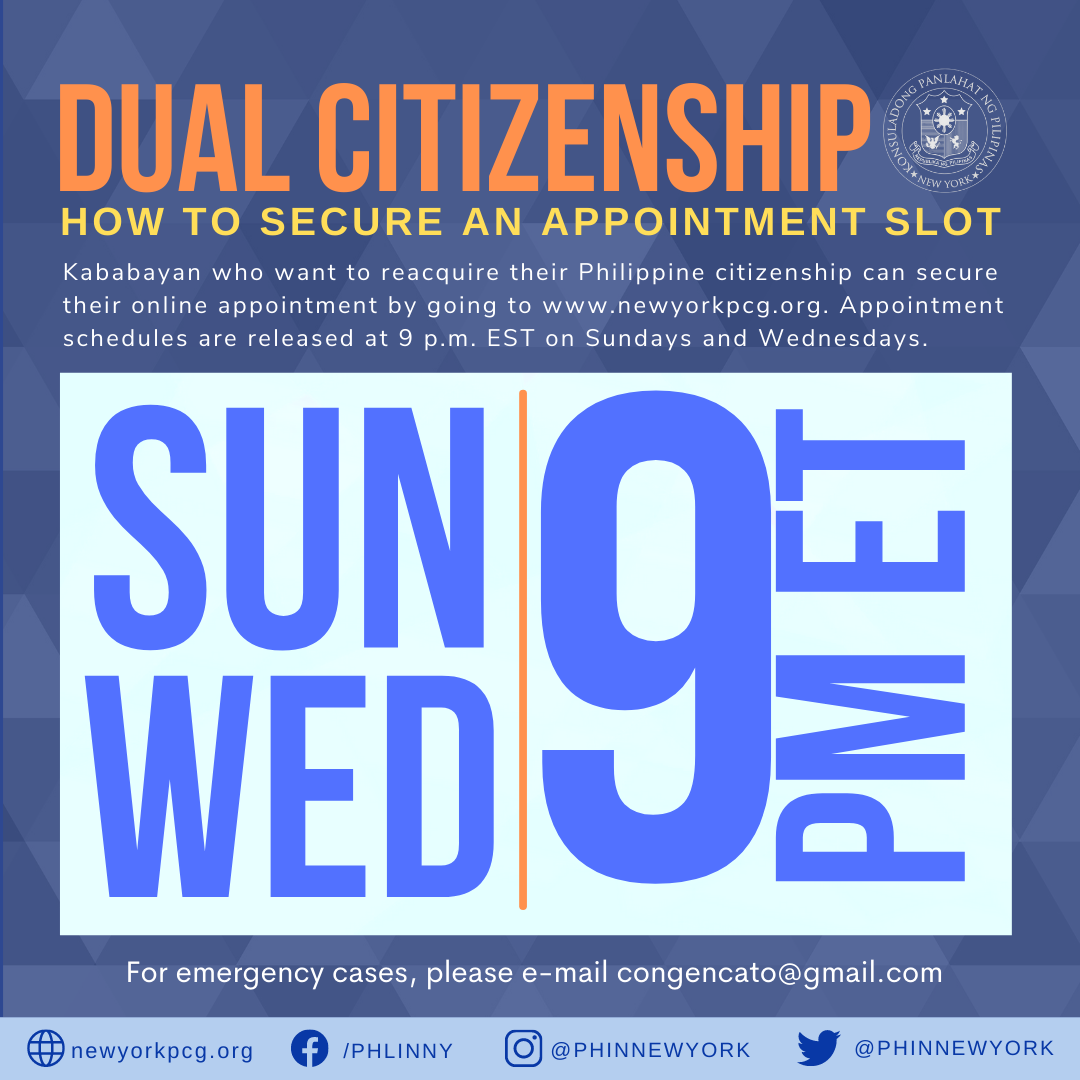

Dual Citizenship Ra 9225 Philippine Consulate General

How To Travel With Two Passports Tickets Entry And Exit With Dual Citizenship

Irs Dual Citizenship Taxes A Quick Reference Guide For Expats

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals

Irs Dual Citizenship Taxes A Quick Reference Guide For Expats

![]()

Construction Projects Contracting Company General Contracting Construction

Taxes For Dual Status And Resident Aliens H R Block

What Are The Benefits Of Dual Citizenship In 2022

Countries That Allow Dual Citizenship In 2022

Do Dual Citizens Renouncing Us Citizenship Pay Expatriation Tax

A Filipino S Guide To Dual Citizenship

Download Uae Vat Dual Currency Invoice Excel Template Exceldatapro Excel Templates Income Tax Invoice Template

Dual Citizenship Exception To Expatriation Substantial Contacts

Traveling As A Dual National Stick To The Rules And You Should Be By Philip Valenta Msf Traveleptica Medium